Paul B Insurance - An Overview

Wiki Article

The Greatest Guide To Paul B Insurance

Table of Contents6 Simple Techniques For Paul B InsurancePaul B Insurance for BeginnersThe Buzz on Paul B InsuranceOur Paul B Insurance DiariesThe 30-Second Trick For Paul B InsuranceThe smart Trick of Paul B Insurance That Nobody is Talking AboutIndicators on Paul B Insurance You Need To Know

No issue exactly how difficult you attempt to make your life better, an unpredicted event can completely transform things upside down, leaving you literally, mentally and monetarily stressed. Having adequate insurance policy assists in the feeling that a minimum of you don't have to consider cash during such a tough time, as well as can concentrate on recuperation.

Having health and wellness insurance policy in this situation, saves you the fears and also tension of arranging money. With insurance in place, any type of monetary stress will certainly be taken treatment of, as well as you can concentrate on your healing.

Paul B Insurance - The Facts

With Insurance policy making up a huge part of the losses organizations and family members can get better instead conveniently. Insurance coverage business pool a large amount of money. Part of this cash can be spent to support financial investment tasks by the federal government. Because of the safety and security worries insurance firms just invest in Gilts or federal government protections.

There are broadly 2 kinds of insurance policy and also let us understand just how either relates to you: Like any type of responsible individual, you would certainly have intended for a comfy life basis your income and also career projection. You and your household will be fantasizing of standard things such as a good residence as well as top quality education and learning for children.

The Definitive Guide for Paul B Insurance

Youngster insurance plans like ULIP as well as savings strategies get an investment value with time. They likewise supply a life cover to the insured. These strategies are perfect to invest in your child's college as well as marriage goals. Term life insurance policy is the pure type of life insurance policy. Term life cover just provides a fatality advantage for a minimal duration. Paul B Insurance.If you have some time to retire, a deferred annuity offers you time to spend for many years and build a corpus. You will certainly get income streams called "annuities" till completion of your life. Non-life insurance coverage is also referred to as general insurance and covers any kind of insurance coverage that is outside the purview of life insurance policy.

In the instance of non-life insurance plan, aspects such as the age of the asset and deductible will likewise affect your option of i was reading this insurance strategy. For life insurance strategies, your age and health and wellness will certainly impact the premium price of the check out this site plan. If you have a vehicle, third-party insurance policy protection is mandatory before you can drive it when driving.

The Buzz on Paul B Insurance

Insurance policy is a legal arrangement between an insurance company (insurance firm) and also a specific (insured). In this case, the insurance provider guarantees to compensate the guaranteed for any kind of losses sustained due to the protected contingency happening. The contingency is the incident that causes a loss. It may be the insurance holder's death or the property being harmed or ruined.

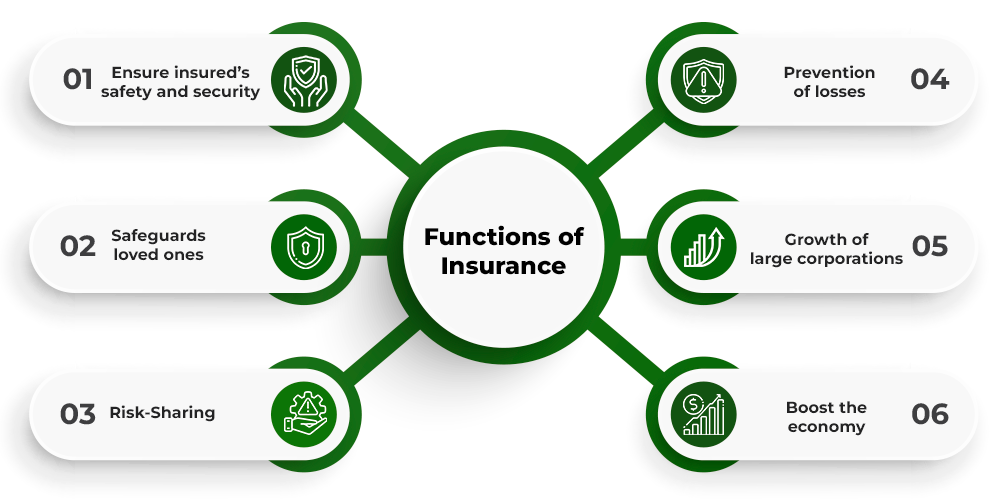

The key functions of Insurance policy are: The vital function of insurance policy is to protect versus the possibility of loss. The moment and also quantity of loss are uncertain, and if a danger happens, the individual will sustain a loss if they do not have insurance coverage. Insurance policy ensures that a loss will certainly be paid as well as thereby secures the insured from enduring.

Not known Facts About Paul B Insurance

The procedure of figuring out costs prices is likewise based on the policy's dangers. Insurance coverage provides payment certainty in the event of a loss. Better preparation and administration can help to decrease the threat of loss.There are numerous second functions of Insurance. These are as complies with: When you have insurance coverage, you have assured cash to spend for the treatment as you receive proper financial help. This is one of the key secondary functions of insurance coverage via which the public is secured from conditions or mishaps.

The feature of insurance coverage is to alleviate the stress as well as distress associated with fatality as well as residential or commercial property devastation. A person can dedicate their heart and soul to much better achievement in life. Insurance coverage provides a motivation to work hard to better the individuals by protecting culture versus substantial losses of damages, devastation, and fatality.

8 Simple Techniques For Paul B Insurance

There are numerous functions and significance of insurance policy. Some of these have actually been offered below: Insurance coverage cash is bought countless campaigns like water system, power, as well as highways, adding to the nation's overall economic prosperity. As opposed to concentrating on a solitary person or organisation, the risk influences numerous individuals as well as organisations.Insurance coverage policies can be used as security for credit rating. When it comes to a home finance, having insurance policy coverage can make obtaining the funding from the lending institution much easier.

25,000 Section 80D Individuals as well as their family plus moms and dads (Age much less than 60 years) link Amount to Rs. 50,000 (25,000+ 25,000) Area 80D Individuals and also their household plus moms and dads (Age more than 60 years) Amount to Rs. 75,000 (25,000 +50,000) Section 80D People and also their family members(Any person above 60 years of age) plus parents (Age greater than 60 years) Complete Up to Rs.

Some Known Details About Paul B Insurance

All sorts of life insurance policy policies are readily available for tax exception under the Revenue Tax Obligation Act. The benefit is gotten on the life insurance coverage plan, whole life insurance policy plans, endowment strategies, money-back policies, term insurance coverage, and also Unit Linked Insurance Program. The optimum reduction offered will be Rs. 1,50,000. The exemption is offered the costs paid on the policies considered self, partner, reliant children, and also dependent parents.This provision also enables a maximum reduction of 1. 5 lakhs. Everyone should take insurance policy for their health. You can select from the different sorts of insurance policy based on your requirement. It is recommended to have a health or life insurance policy given that they prove beneficial in bumpy rides.

Insurance coverage helps with moving of danger of loss from the guaranteed to the insurance firm. The basic principle of insurance coverage is to spread risk amongst a a great deal of individuals. A large population gets insurance plan and also pay costs to the insurance firm. Whenever a loss happens, it is compensated out of corpus of funds accumulated from the countless insurance policy holders.

Report this wiki page